Compensation & BenefitsPayroll

Payslips Explained: How to Interpret Gross Pay, Net Pay, and Common Deductions

TABLE OF CONTENTS

Management often focuses on payroll strategies to maintain efficiency and keep workers motivated. However, it is important that employees see how their compensation is calculated. When reviewing payslips, there are various terms and factors to consider. This includes elements like gross pay, net pay, and the common deductions found on a payslip. By breaking down each line item, individuals gain stronger financial awareness, and employers can reinforce transparency and trust.

A study revealed that 78% of workers globally rely on a payslip to verify payment details. In many countries, it is a legal obligation for employers to issue a payslip each pay period, whether that timeframe is weekly, biweekly, or monthly. When employees understand their earnings, they can make informed choices about saving, budgeting, and investing. Clarity also encourages people to address any discrepancies or concerns, which supports open communication between staff and management.

Organizations often treat payroll as a priority. A well-organized payslip can reduce the chance of confusion about compensation and help employees follow their year-to-date amounts for tax or retirement. This openness also lessens the load on HR and finance teams because employees have fewer questions about withheld tax or other deductions. When everyone knows where their money is going, it is simpler to spot errors and resolve them quickly.

Understanding Payslips and Their Role in Employment

A payslip is a document that breaks down an employee’s earnings and all relevant deductions for a specific pay period. It allows staff members to check their income, track withholdings like tax deductions, and confirm that their hours worked and pay align. In many regions, distributing payslips is also a matter of compliance, since labor laws require it for accurate employment records.

Aside from detailing an employee’s pay, a payslip serves as evidence of employment, which may be needed when applying for bank loans, mortgages, or visas. By reviewing it routinely, an employee can verify that all details match their expectations. If anything seems off, they can contact the employer right away.

Key Components of a Typical Payslip

A typical payslip, often called a pay stub, contains important details about an employee’s payment during a defined pay period. While laws differ from place to place, most payslips include the same core elements to ensure clarity.

Employee Information

A standard pay slip usually begins with the employee id, name, and address. Employers rely on this information to maintain precise records of employment, while government agencies may use it to confirm that the right worker is receiving wages. When there are errors, companies will usually have to rectify them by reissuing payments or by making corrections to withholdings.

Pay Period and Dates

Each payslip indicates the exact pay period it covers, along with the date on which the payment is issued. The pay period might be weekly, biweekly, or monthly, or it could match special project timelines. Regardless of the format, knowing these dates is crucial. It ensures that the employee can compare their hours worked to the correct schedule and spot any inconsistencies. Paying attention to these dates also helps with personal finance planning, especially if overtime or extra tasks can alter the final pay for that cycle.

Some organizations place special emphasis on the current pay period, which signifies the specific timeframe for which the employee receives compensation. Tracking the current pay period helps reduce confusion about whether shifts or extra tasks were counted properly, and it confirms that each employee is paid accurately for that specific pay period.

Earnings on the Payslip

The earnings section lists what the employee makes before any deductions. This can include salary, hourly wages based on hours worked, and any bonuses or overtime pay. Hourly employees will see different calculations if they exceed their regular hours. For instance, in the United States, overtime beyond 40 hours in a week is often paid at one-and-a-half times the usual rate. Organizations rely on these rules to calculate extra compensation. According to data from the International Labor Organization, 39% of employers worldwide use performance-based bonuses to reward workers.

It is helpful for employees to examine their total earnings line to make sure they received everything they earned. This might involve verifying overtime pay or ensuring that any special incentives appear correctly. When earnings data is accurate, employees are less likely to challenge their pay, and overall employment relations can improve.

Gross Pay vs. Net Pay

Gross pay represents the total amount an employee earns for a pay period before deductions. It includes salary, overtime, and other forms of compensation. Net pay is what the employee takes home after tax, insurance, and other withholdings are deducted. Net pay often appears at the bottom of a payslip. It reflects the cash that lands in the employee’s bank account or the check they can deposit. By comparing gross pay and net pay, employees can see how tax deductions, health insurance premiums, and employer contributions to retirement plans affect their take-home pay.

Some employees review these amounts to make sure they are on track with their financial goals. If someone notices that too much is withheld for tax, they might adjust their filings or allowances. If they want to increase their retirement savings, they can add more to their retirement plans, raising the withheld portion of their gross pay. This process encourages proactive decisions about personal finances.

Deductions and How They Affect an Employee’s Paycheck

Before the employee receives net pay, certain mandatory or voluntary deductions apply. The following items are common: income tax, social security contributions, health insurance premiums, and any union dues. Many workers also see tax deductions for local or federal obligations. Some may have a portion of their pay set aside for bank loans, wage advances, or other personal obligations that the company manages on their behalf.

These deductions can vary based on contractual agreements, legal demands, or personal choices. According to a survey by the Chartered Institute of Payroll Professionals, about 40% of employees choose additional insurance or opt for higher retirement plan contributions. Understanding these subtractions is vital. When people are aware of exactly how much is being deducted and why, they have fewer disputes, and they feel more secure about where their money is going.

Tax Deductions and Taxable Wages

Taxable wages refer to the portion of an employee’s earnings that is used to figure out income tax. After certain allowances or exemptions are accounted for, the final figure becomes the basis for tax calculations. Employers then apply tax rates to calculate how much should be withheld. These are recorded as tax deductions on the payslip. Employees can use these figures to determine if they might owe more or expect a refund at the end of the current year.

Industry surveys show that transparent tax reporting can help employees avoid unpleasant surprises when filing annual returns. By keeping track of withheld tax each pay period, individuals know whether they are meeting their obligations. This clarity also helps them adjust deductions if their personal or financial situation changes.

Year-to-Date Totals and Their Significance

Many companies highlight accumulations for earnings, deductions, and tax withholdings on a payslip. These running totals can show how far an employee has come toward their annual salary or how much they have contributed to funds like insurance or retirement. They also reveal how many taxes have been withheld so far.

Monitoring this accumulated data is a good way to see if you might enter a new tax bracket or if you have contributed enough to your retirement plans. It can also help if you plan to buy a home or apply for bank loans since these totals prove that you have stable income. If you notice that your net pay drops in the middle of the year because of an increase in withholdings or other benefits, checking the year-to-date figures can explain why.

Global Payroll and Compliance Across Borders

When dealing with a global payroll system, employers face the task of managing different tax rules, cultural norms for hours, and unique laws related to benefits or insurance. A company in North America that hires workers in Europe must ensure compliance with all local requirements. They may also need to account for currency exchanges that can affect the final payment on a payslip.

Furthermore, some research by larger accounting firms found that 62% of multinational firms invest in specialized software to calculate pay across many regions. Such systems integrate with HR platforms to keep track of employment regulations in each country. They handle double taxation scenarios when an employee is assigned to a foreign branch and might owe partial taxes at home and abroad. Managing a global payroll can be challenging, but proper technology and clear communication reduce errors and help workers understand their final paycheck.

Practical Example of a Standard Payslip

Consider an example involving a two-week pay period. An hourly employee earns a base of $2,000, which includes 80 hours of regular work plus 5 hours of overtime pay at time-and-a-half. From this $2,000 in gross pay, $300 covers federal, state, and local taxes. Another $100 goes toward health insurance premiums. Retirement contributions might total $150 from the employee, and there could be an additional $150 in employer contributions. After all deductions, the net pay might be $1,450.

The above example shows how the total amount of gross pay shrinks when each required or elected deduction is subtracted. The date of payment on the payslip confirms that these hours worked fall under that specific pay period. If the employee sees a mismatch, such as fewer hours than they worked, they can promptly request an investigation. Having a record of earnings and withheld amounts simplifies budgeting.

In many companies, the payslip also displays totals for earnings, withholdings, and the total amount of tax paid so far. By looking at the details, workers can determine whether any cost for insurance seems off or if their overtime was calculated correctly. If there is an inconsistency, they can discuss it with human resources or payroll.

Best Practices for Employers and Employees

Employers and employees can work together to ensure that every paycheck remains accurate and transparent. A few approaches can enhance the process of reviewing and issuing a payslip.

Clear communication is essential. Employers should explain how they calculate each type of pay, from base salary to bonuses. Employees who notice changes in cost or deductions should feel comfortable seeking answers about what may have shifted, such as tax rates or insurance plan updates. This openness encourages an environment of trust, minimizing frustration.

Regular reviews of each pay stub can help spot errors early. An employee might compare their timesheet with the hours shown on the payslip or confirm that the correct rate for overtime was used. Any gaps can be fixed quickly, reducing confusion for both the employee and the company.

Adhering to legal requirements is another priority. Different regions mandate what details must be on a typical payslip or when it must be issued. Missing or incorrect details might lead to fines or other penalties. By keeping up with these rules, employers demonstrate compliance and show that they respect labor standards.

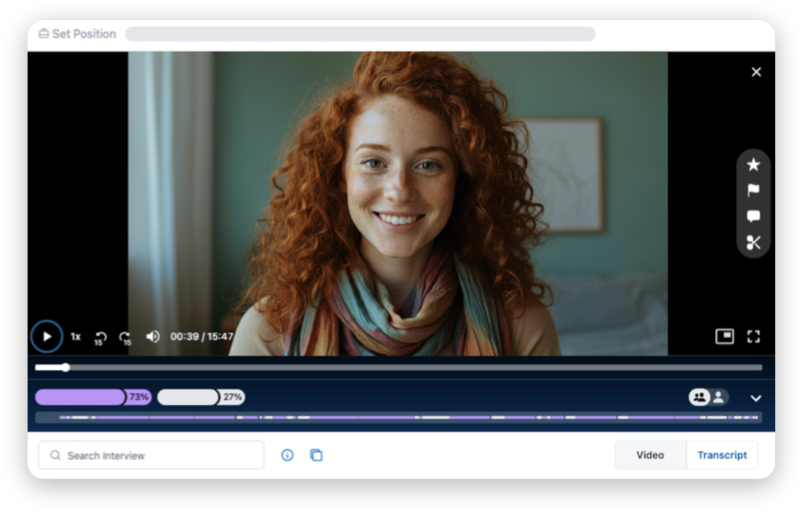

Using digital tools allows employees to access their payslips online. This approach keeps a record of previous payments and shows how year-to-date figures have changed. Some systems even automate complicated tax calculations. When employees can log in to an online service, they can confirm their withholdings, check overtime calculations, or review any changes in their allowances.

If the structure of the payslip seems confusing, an employee may want to consult their human resources department or a payroll professional. Some employers rely on outside experts to manage global payroll so that employees working in multiple countries receive consistent and accurate payments. In these cases, specialists also help the company stay current on changing tax laws.

Employees can safeguard their financial well-being by storing each paycheck record from every pay period. These documents provide proof of income when applying for bank loans or verifying one’s employment history. They also help with monthly budgeting, tax planning, and spotting any unusual fluctuations in net pay. Some companies even offer training sessions on tax brackets, retirement plans, or different insurance packages to help employees make decisions about voluntary deductions.

Accurate Payroll: The Foundation of Trust and Organizational Health

Many people do not realize how central payroll is to organizational health. An overlooked mistake in employee pay can create tension, while accurate, transparent payslips encourage confidence and loyalty. When staff see that their pay is correct, that tax is handled responsibly, and that their other benefits are funded on time, they are more likely to trust leadership. This trust can improve overall morale and reduce turnover.

Ensuring the accuracy of each paycheck benefits everyone. By clarifying how a pay period is defined, by showing how gross pay is reduced to net pay, and by listing each deduction in detail, employers strengthen their relationship with their teams. Meanwhile, individuals gain the information they need to plan effectively for daily expenses and for larger goals like buying a home, investing, or setting aside an emergency fund. With thorough documentation of employee’s earnings, it becomes simpler for both sides to work out any issues promptly and maintain a stable, transparent system of pay.

Frequently Asked Questions

What Does YTD Stand For on a Payslip?

On a payslip, YTD stands for “Year to Date,” referring to the total amount an employee has earned from the start of the calendar or fiscal year until the current pay period. It includes details such as gross earnings (total income before taxes and deductions), net pay (income after deductions), taxes withheld, and other contributions. These figures help employees see how much money they’ve made and what amounts have been taken out throughout the year.

What is the Purpose of a Payment Slip?

A payslip or ,pay stub, clearly shows an employee’s earnings and deductions for each pay period. It ensures transparency, making certain that employees understand exactly how much they earn and what has been deducted from their pay. Payslips also serve as proof of income, which employees need when applying for loans, renting homes, or filing taxes.

Employers use payslips to show compliance with labor laws, demonstrating that they pay workers correctly and follow legal standards. If disagreements occur about a staff member’s salary, payslips are important records that help resolve these disputes.

How to Get a Payslip?

Employees usually get their payslips from their employer at the end of each pay period, either as a printed document or electronically through email or an online portal. Many businesses use payroll software or apps, allowing employees to view and download their payslips.